Please Click the Video to Watch This Important, Short Message

In this week’s Hidden Wealth Reviews, I teach a powerful lesson; today’s tax savings can be tomorrow’s tax burden. Please go to www.RetirementProtected.com and register for this coming Tuesday’s Remove Your Wealth from Washington webinar. At this no-cost, no-obligation financial educational event, I will teach you what our client, Mike, learned just this week.

Mike is in his late fifties and he’s saved just over $600,000 towards his retirement. Unfortunately, Mike followed the crowd and put his money into traditional IRAs and 401(k)s. Our experience has shown that 95% of the people reading this blog have saved their money in these types of accounts. For those who have saved this way, their tax bill has not yet come.

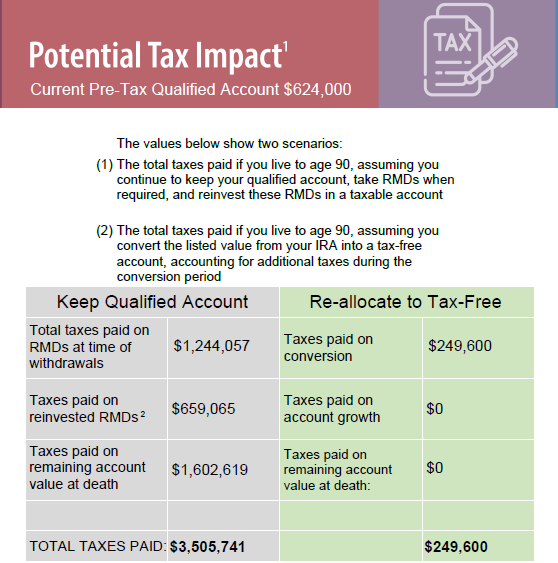

Mike discovered his total retirement tax bill burden. When we asked Mike to guess his lifetime tax bill, he had no idea what he was facing. After our team of CPAs and CFPs reviewed his situation, we calculated that, at his tax rate of just over 30%, Mike is on track to pay $3.5 million in taxes over his lifetime! That’s his cost just to access his own money. That’s more than five times the amount he saved. Remember, this tax is due on savings amount of just over $600,000. Below is what Mike’s current tax risk road looks like, compared to the tax risk road he could be traveling.

This problem isn’t unique to Mike. On the surface, it’s hard to imagine that people would deposit their money into a system where you can pay five time as much in taxes as you’ve saved. However, whether you’re in your late fifties or your late seventies, this is how it works. The tax multiple may not be five times as much as you’ve saved, but it will certainly be at least a one to one or a two to one ratio, depending on your age and rate of return.

The good news is that you can act now to change your future. This Tuesday, at my Remove Your Wealth from Washington webinar, I will be teaching strategies to protect your hard-earned money from the tax-deferred savings account tax trap. Don’t let today’s (assumed) tax savings become tomorrow’s larger tax burden and possibly an even larger burden for your children and your heirs.

On Tuesday, I will teach you multiple strategies that will allow you to move your money from taxable retirement savings accounts to tax-free accounts. I will also teach you how to use tax credits and tax deductions to offset the taxes that would normally be due when you remove your money from taxable accounts. Let me teach you unique strategies that will save you tax!

If you really want to protect, preserve and grow your retirement, get your money out of the tax system. At Tuesday’s webinar, I will teach you how to do this in the most tax-efficient way possible.

The markets have reacted positively to Donald Trump’s election and his promises to improve the economy and to control taxes. This enthusiastic market response has pushed American’s account balances higher. While this is good news today, it’s also pushing tomorrow’s taxes higher.

Donald Trump has promised us an economy “the likes of which nobody has ever seen.” If this holds true and if the predominate amount of your retirement savings is in tax-deferred accounts, you are simply pushing your future tax bill higher the longer you wait to get your money un-taxed.

But increased taxes due to higher balances is only one of the dangers. Should the markets take a downturn along the way, your account balance could go the other way very quickly. At Tuesday’s webinar, I will also teach you how to protect yourself from market downturns. These are the strategies that are used by the ultra-wealthy. Learn how the ultra-wealthy are able to grow, protect and pass their money outside of the tax system.

How Big is Your Retirement Tax Bill?

Learn More About Reducing Your Tax Burden

Your work hard for your money. Imagine, avoiding becoming Mike. Mike is glad that he took the time to learn by attending our no-cost, no-obligation financial education webinar.

Mike started his journey by learning the tax risk road that he’s traveling and then he compared that to the road that he could be traveling. Using just a few of the strategies he learned, he will completely remove himself from the tax system next year! The urgency couldn’t be greater. The Congressional Budget Office (CBO) recently reported that about 62% of all taxpayers will see their taxes increased if the Tax Cuts and Jobs Act tax sale sunsets at the end of 2025, as scheduled.

Imagine freeing yourself from the tax trap that so many traditional retirement accounts create and taking advantage of the lowest tax rates we may ever see. Don’t let the blessing of an economy the likes of which nobody has ever seen today turn your perceived tax-savings today into an even bigger tax liability tomorrow. Learn how to protect your savings and grow your wealth without the tax burden.

Register for Tuesday’s webinar by following these four simple steps:

- Go to www.RetirementProtected.com.

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!”

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event.

Spouses and Significant Others are Encouraged to Attend This Event Together

Note: We serve Boomers and Retirees all over the Unites States. We have an efficient, supported process to meet online, as have been doing for over 20 years. Our online meetings are private, the access is restricted and we never share our meeting link with anyone who’s not a part of the meeting.

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com