Please Click the Video to Watch This Important, Short Message

REMOVE ECONOMIC UNCERTAINTY

Many financial experts are predicting a repeat of the 2008 recession. Clients have reached out to us, concerned about the threat of a retirement ruining recession. I want to teach you how Baby Boomers and retirees can protect and provide peace of mind in their retirement using the core four retirement recession risks with the acronym T.I.M.E. which stands for:

- Taxes are heading higher

- Inflation is still increasing

- Markets are more volatile

- Economic uncertainty will continue

The CNBC All American Economic Survey shows that Americans are more pessimistic about the economy than ever. The survey indicated that 69% of the population has negative views on the economy. Seventy five percent of working class Americans say they are cutting back on entertainment and dinning. Interestingly, 54% of wealthy Americans also indicated that they are cutting back.

Click Here to learn some of the things I want to teach you to do to avoid economic uncertainty.

LEARN MORE ABOUT HOW TO REMOVE ECONOMIC UNCERTAINTY.

Here are the things I want to teach you how to avoid:

- Market volatility that can keep you from being or staying retired

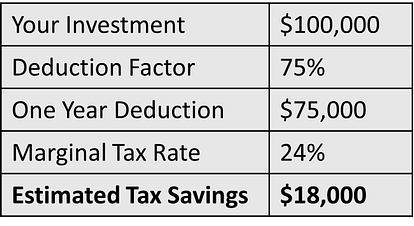

- Losing large amounts of income to taxes

- Worrying about running out of money or lowering your retirement lifestyle

- Pinching pennies in order to enjoy the freedom, flexibility and lifestyle you really want

- Waiting until two-thirds of your life has come and gone to really LIVE!

Learn how to not just survive in retirement and crippling recession markets but how to thrive in them during retirement! This Tuesday, I will teach you why now is the time to protect yourself from recessions, bigger taxes, higher inflation and stock market crashes. It’s time we take matters into our own hands and take every precaution necessary to protect ourselves. Learn how you can have the ability to give yourself retirement stability. Register now for Tuesday’s Wealth Protection Webinar and learn how you can protect your money by removing economic uncertainty.

- Go to www.RetirementProtected.com (or scroll down to the form below).

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!” to submit, that’s it!

Strong savers in 401(k)s and IRAs and high income earner are the people who will benefit the most from our proven solutions. Proven solutions with a track record of measurable results. Imagine less stress, less worry. Peace of mind retirement protection.

Register for your preferred webinar time now because these events have proven to fill up fast.

Those who attend this event will receive a complimentary copy of my latest eBook:

The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.