Please Click the Video to Watch This Important, Short Message

In this week’s Hidden Wealth Review, I teach about the one move that can add years to your nest egg by helping you avoid unnecessary taxes. A client of ours recently said, “I want to avoid a deep relationship with the government when it comes to taxes.” That’s a smart goal. Let me teach you how you can do the same.

Many people have kept their money in traditional IRAs and 401(k)s, thinking that the recent election of Donald Trump will keep taxes down. Right now, the economy is bouncing back and retirement accounts are growing fast. While that sounds great, it comes with a hidden cost: the larger your account grows, the bigger your tax bill will be when you withdraw your money. Many people think they have time to deal with taxes later, but the truth is, waiting only makes it worse. The longer you wait, the more taxes you will pay.

Let me teach you why taking advantage of Roth conversions early can add a number of years to your nest egg and to your family’s legacy. To learn why now is the time to do tax-advantaged Roth conversions, register for this coming Tuesday’s Remove Your Wealth from Washington webinar at www.RetirementProtected.com.

A couple in their late forties recently came to us with $200,000 left in a traditional retirement account such as an IRA or 401(k). They were concerned because they had seen the devastation that taxes had caused in their parents’ retirement. They thought they were doing fine because they had already converted some of their savings to a Roth IRA. What they didn’t understand was that leaving the remaining $200,000 in their tax-deferred account would have cost them more than $2.1 million in taxes over their projected lifetimes!

We showed them that they needed to act now by converting their remaining savings to a Roth IRA. This helped them avoid years of tax headaches, reduced their risk and nearly doubled their returns. The solution we taught them didn’t just grow and protect their nest egg from unnecessary taxes, it also created a tax-free legacy for their family that’s projected to be twenty times larger!

How Big is Your Retirement Tax Bill?

Learn How To Add Years To Your Nest Egg

Whether you’re in your forties, fifties, sixties, or even your seventies, it’s never too early and it’s never too late to get a written, well-deserved tax and retirement plan. The sooner you act, the more you save. Waiting only increases your tax burden which leaves less for you and your loved ones. Remember, every dollar you delay is a dollar lost, while every dollar you save is one you can use for your retirement lifestyle or pass on to your loved ones.

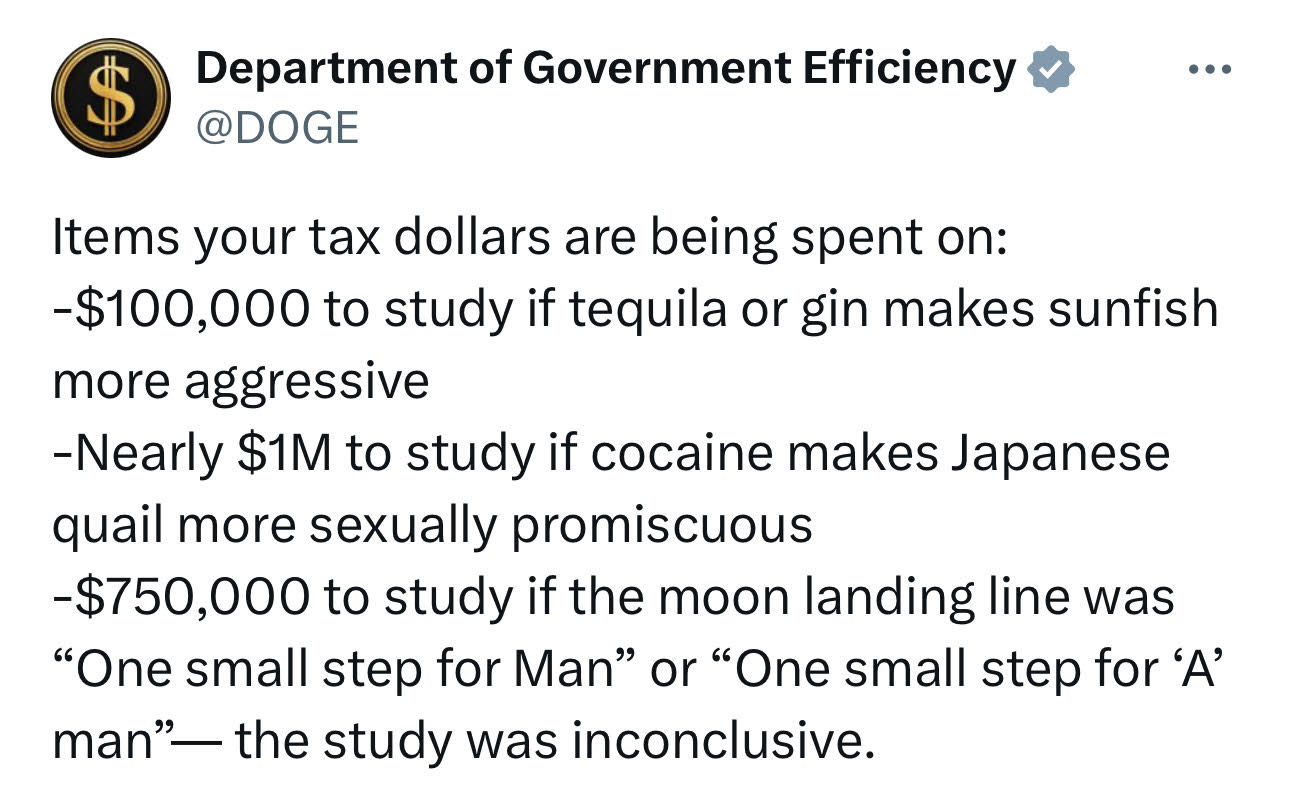

Fraud, waste and abuse is everywhere in our government which spends our tax dollars in unthinkable ways—like $1 million studying cocaine’s effects on Japanese quail or $750,000 to analyze a moon landing phrase. Just take a look at the post below to see these and other ridiculous, outrageous and unnecessary expenditures of our tax money.

Instead of letting your money fund wasteful government projects, take control of your retirement savings now. Learn how to do this at Tuesday’s Remove Your Wealth from Washington webinar.

Imagine being able to avoid a deep relationship with the government when it comes to taxes. Don’t let the cost of waiting eat away at your retirement and your family’s legacy. Register now for this coming Tuesday’s no-cost, no-obligation webinar by following these four simple steps:

- Go to www.RetirementProtected.com.

- Select the webinar date/time you prefer.

- Enter your information carefully and double-check your email address.

- Click “Reserve My Spot!”

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event.

Spouses and Significant Others are Encouraged to Attend This Event Together

Note: We serve Boomers and Retirees all over the Unites States. We have an efficient, supported process to meet online, as have been doing for over 20 years. Our online meetings are private, the access is restricted and we never share our meeting link with anyone who’s not a part of the meeting.

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com