Please Click the Video to Watch This Important, Short Message

wave of taxes

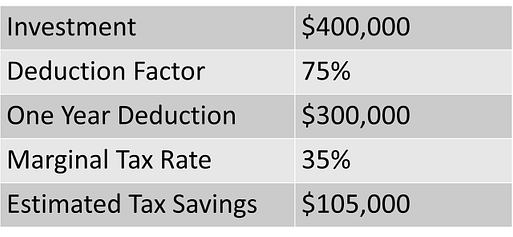

In this week’s Hidden Wealth Reviews, I teach about the tax tidal wave. The New York Times recently reported that deficit spending will go up an astonishingly $7 trillion over the next 10 years! The report shared that deficit spending has already increased $3 trillion more than was originally projected. Unfortunately, the spending just keeps on continuing.

Click Here to discover how two of our clients were able to pay the legally least amount of tax possible and escape the tax traps the government had set for them.

LEARN MORE ABOUT HOW TO AVOID A TIDAL WAVE OF TAXES!

- Go to www.RetirementProtected.com (or scroll down to the form below).

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!” to submit, that’s it!

Strong savers in 401(k)s and IRAs and high income earner are the people who will benefit the most from our proven solutions. Proven solutions with a track record of measurable results. Imagine less stress, less worry. Peace of mind retirement protection.

Register for your preferred webinar time now because these events have proven to fill up fast.

Those who attend this event will receive a complimentary copy of my latest eBook:

The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.

Spouses and Significant Others are Encouraged to Attend This Event Together

Note: We serve Boomers and Retirees all over the Unites States. We have an efficient, supported process to meet online, as have been doing for over 20 years. Our online meetings are private, the access is restricted and we never share our meeting link with anyone who’s not a part of the meeting.

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com