Please Click the Video to Watch This Important, Short Message

In this week’s Hidden Wealth Reviews, I teach that financial experts predict that one move could save you thousands in retirement. This involves removing your income and assets from the tax system before retirement or removing yourself from the tax system during retirement. Both methods can work, but one tends to save you more by taking an early, proactive approach towards taxes.

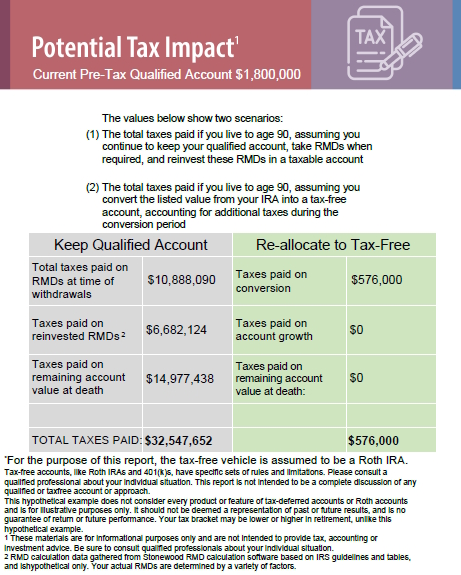

Let me share the story of a couple in their mid-forties. They were referred to us by another financial advisor. They were both high-income earners and they had saved a substantial amount in tax-deferred retirement accounts (around $1.8 million). Because we have a comprehensive tax planning team, we are able to provide our clients with a comprehensive, written retirement plan that incorporates tax elimination.

They came to us looking to save income taxes. We asked them to predict their future tax exposure. Predictably, their estimate was way off. Fortunately, we were able to show them the tax risk road they were traveling.

After we showed them the amount of tax exposure they had, not just on their income, but on the tax-deferred money that they have saved for retirement, they discovered that they could access their current employer’s 401(k)s while they were still working. This allowed them to convert those accounts to Roth IRAs right now. I’ll be teaching this Tuesday in our Remove Your Wealth from Washington webinar how this is possible.

After our team of CPAs and CFPs analyzed their situation, we ran projections based on their returns and tax rates. The results were staggering. Over their families’ lifetimes, the taxes on their savings would amount to $32 million, over 18 times the $1.8 million they had saved! Imagine, saving your whole life only to have taxes wipeout the majority of your hard-earned money!

The good news is that we showed them how to avoid this scenario and they now have a plan that will save them $32 million in taxes. By using strategies that I will teach in this coming Tuesday’s Remove Your Wealth from Washington webinar, they were able to remove their savings from the tax system yet continue to keep their savings growing. Through careful planning, we even helped them reinvest the money they would have otherwise paid in taxes, thus accelerating their path to retirement.

Their story is not unique. Whether you’re still working or already retired, the reality is that tax-deferred accounts like 401(k)s and IRAs are ticking tax time bombs. Most retirees we meet are paying more taxes in retirement than when they were working. The longer you wait to address taxes, the bigger your tax burden grows, especially with market rallies such as the recent “Trump bump.” With tax rates at historic lows, now is the time to act. Many provisions of the Tax Cuts and Jobs Act (TCJA) are set to expire in the next 12 months. Waiting means paying more taxes in the future. If you wait, you could lose the chance to save thousands (or even millions) in unnecessary taxes.

Imagine a retirement where you don’t pay taxes on your Social Security, your Medicare or your income. This isn’t just a dream, it’s the reality for many of our clients who have taken the steps to become tax-free retirees. I’ll teach you how to do the same this Tuesday.

How Big is Your Retirement Tax Bill?

Learn More About How To Save Thousands In Retirement

Whether it’s using tax credits, deductions or strategies to offset conversion costs, there are proven methods to eliminate taxes and secure your savings. If you’re sick of paying unnecessary taxes and tired of the stock market’s roller coaster ride from the ceiling to the basement, go to RetirementProtected.com and register for Tuesday’s webinar. Let me teach you strategies that allow you to keep more of your hard-earned money for yourself and your family.

Whether you’re trying to remove yourself from the tax system before retirement or during retirement, the time to act is now. The TCJA is set to sunset in the next 12 months, which means today’s historically low tax rates could soon disappear. Don’t wait until it’s too late.

You work hard for your money. Don’t let taxes take away what you’ve built. Take control of your savings, protect your legacy and secure your financial future. Join me this Tuesday at RetirementProtected.com.

Register for Tuesday’s no-cost, no-obligation webinar by following these four simple steps:

- Go to www.RetirementProtected.com.

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!”

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event.

Spouses and Significant Others are Encouraged to Attend This Event Together

Note: We serve Baby Boomers and Retirees all over the Unites States. We have an efficient, supported process to meet online, as have been doing for over 20 years. Our online meetings are private, the access is restricted and we never share our meeting link with anyone who’s not a part of the meeting.

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com