Please Click the Video to Watch This Important, Short Message

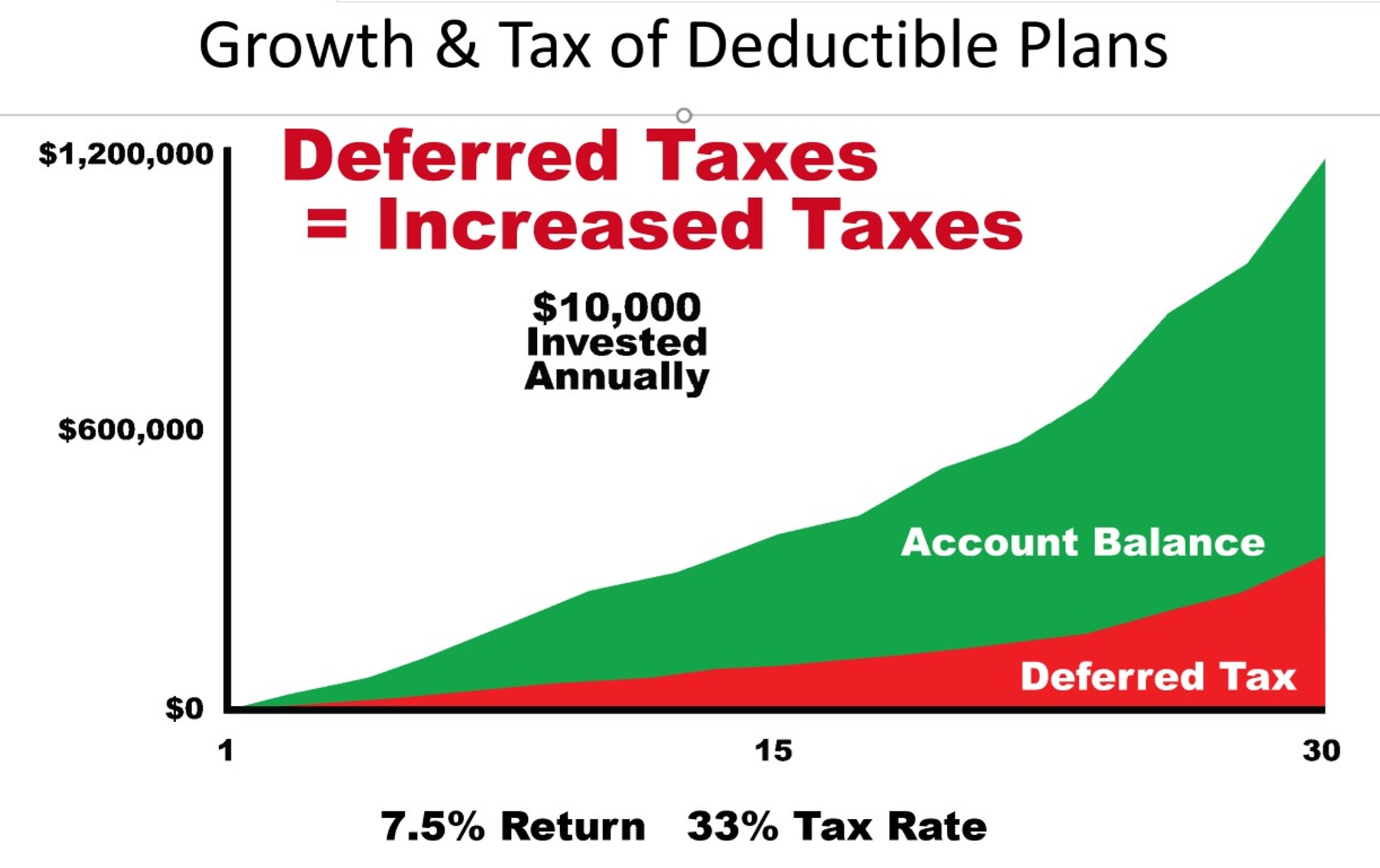

heavy costs

Click Here to learn how Roger discovered how he could use a Roth Alternative Safe Money Fund to avoid unnecessary taxes, maximize his income and then pass the remainder of his money to his son, tax-free.

Learn More About HOW TO Avoid the Heavy Costs of Following the Crowd

- Go to www.RetirementProtected.com (or scroll down to the form below).

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!” to submit, that’s it!

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event. Don’t forget to add it to your calendar!

Strong savers in 401(k)s and IRAs and high income earner are the people who will benefit the most from our proven solutions. Proven solutions with a track record of measurable results. Imagine less stress, less worry. Peace of mind retirement protection.

Register for your preferred webinar time now because these events have proven to fill up fast.

Those who attend this event will receive a complimentary copy of my latest eBook:

The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.

Spouses and Significant Others are Encouraged to Attend This Event Together

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com