Please Click the Video to Watch This Important, Short Message

THREE KEY RETIREMENT

In this week’s Hidden Wealth Reviews, I teach about the key three areas that save our clients from losing sleep over the current chaos of market volatility and economic uncertainty. This Tuesday, at my Wealth Protection Webinar, I will be teaching strategies that the ultra wealthy have been taking advantage of for years to prevent losses, improve performance and eliminate taxes.

Click Here to learn the key three areas and why learning how to control them is vital to protecting yourself from market losses and rising inflation.

Here are the key three areas:

- Tax Elimination

- Income Maximization

- Lifestyle and Legacy Preservation

Many people have told me that controlling these three sounds “too good to be true.” I’m speaking of strategies that have no market downside losses, only upside gains and all of it can be designed totally tax-free. This is the type of planning we do and it is not too good to be true, it is true! This has been the foundation of our client family’s finances. You can learn these strategies too by registering for and attending this Tuesday’s webinar.

I have spoken to a lot of people who were initially resistant and put off learning about these proven strategies. Most of them have shared their regret at having waited to take action. This is especially true of those who lost money in the market in 2000, 2001, 2002 and then again in 2008 and 2009. Over this entire ten year period, the market lost over half its value, twice. This resulted in “the lost decade” which caused many retirees to delay their retirement while others were pushed back into the workforce!

Concerned people now tell me that they know they no longer have enough time before retirement (let alone those already in retirement) to make up for another round of sizeable losses from a major market correction or a significant tax increase. They express that they don’t want to:

- Have to go back to work

- Lower their lifestyle

- Leave a huge tax burden to their family

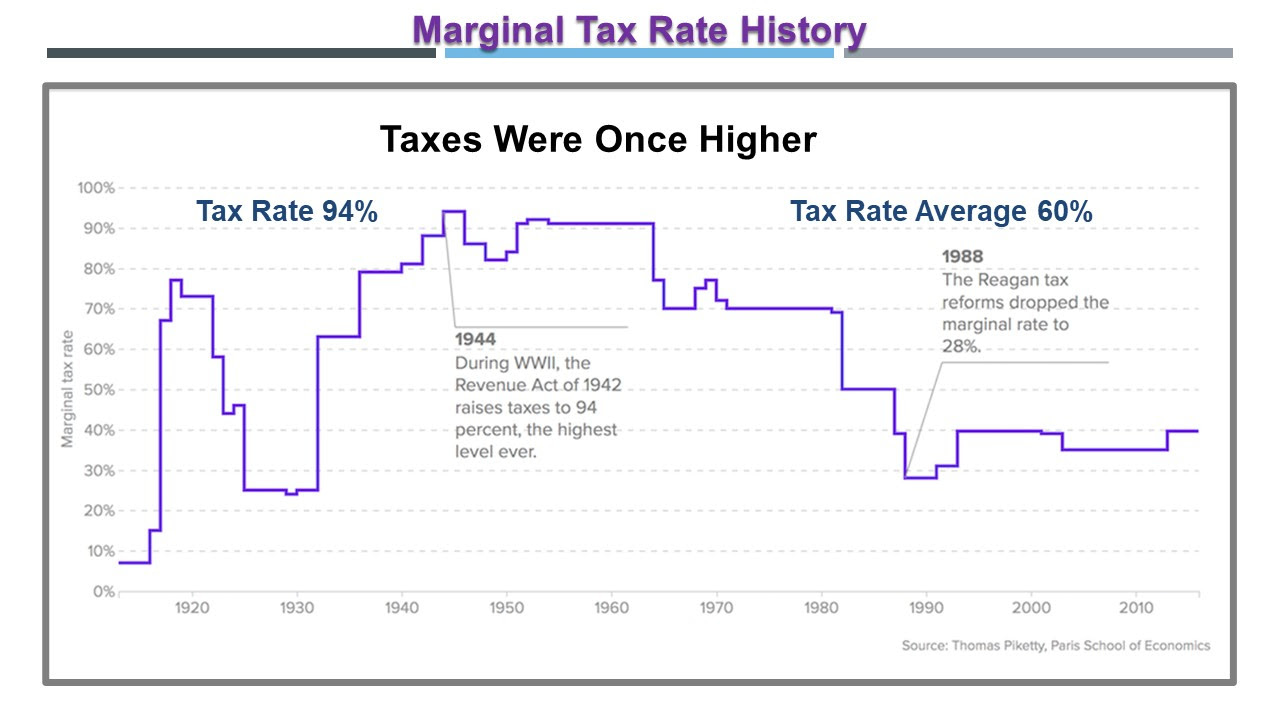

At Tuesday’s webinar, I will teach you that you can tackle all of these retirement threats. Imagine, eliminating unnecessary taxes, saving you thousands of dollars. That’s important because this administration is spending money like a drunken sailor and that’s going to translate into significantly higher taxes (on top of the higher inflation we’re experiencing). The graph below shows that taxes have been higher in the past. As you can see, tax rates are currently on sale. They have been a lot higher after major spending, based on the historical data.

Ready to Learn More About The Three Key Retirement Musts?

Whether you’re trying to get to retirement or better through retirement, your lifestyle is at risk of being reduced. Maximizing income begins by eliminating taxes. Many of our clients have shared that their past financial advisors didn’t even talk about taxes and that their CPAs didn’t help eliminate taxes, they just filed the returns. The only way to protect you is by learning how to protect yourself!

One of the things I’ll be teaching on Tuesday is what I call the rich man’s Roth. This strategy eliminates the risk of market losses, capital gains, income taxes and leaving a huge tax bill to your children. You’ve worked hard for your money. Let’s get to work protecting and preserving it. It’s time to reinvent retirement!

To register for Tuesday’s no-cost, no-obligation, log on and learn financial educational event, simply follow these four simple steps:

- Go to www.RetirementProtected.com (or scroll down to the form below).

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!” to submit, that’s it!

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event. Don’t forget to add it to your calendar!

This misguided administration’s plans are targeting high income earners and strong savers in 401ks and IRAs. These are the people who will benefit the most from our proven solutions. Solutions with a track record of measurable results.

Register for your preferred webinar time now because these events have proven to fill up fast.

Those who attend this event will receive a complimentary copy of my latest eBook:

The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.

Spouses and Significant Others are Encouraged to Attend This Event Together

Note: We serve Boomers and Retirees all over the Unites States. We have an efficient, supported process to meet online, as have been doing for over 20 years. Our online meetings are private, the access is restricted and we never share our meeting link with anyone who’s not a part of the meeting.

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com