Please Click the Video to Watch This Important, Short Message

inflation and taxation

In this week’s Hidden Wealth Reviews, I share that there are a few things you should take away from all of the craziness that’s going on right now. I want to teach you how to avoid the reckless disregard of this non-retirement reality.

- This week, Credit Suisse projected that food prices will rise 16% in 2022 and even higher in 2023.

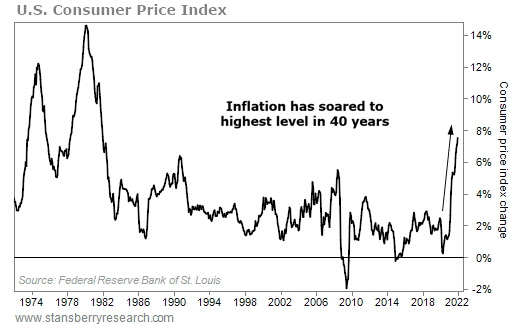

- We have the highest inflation rate in almost 50 years (nearly 8%). There are lots of people who aren’t even earning 8% on their money! They are essentially going backwards in their account values, on top of all their market losses.

- No one is addressing how to avoid the higher taxes that are coming.

- It appears that the stock market is now in “bear” territory. Many people are anticipating further declines in stock prices due to Russia’s actions and The Federal Reserve’s coming rate hikes.

The chart below graphicly shows that inflation is now at it’s highest level in nearly 50 years.

As a result of the turmoil, people from all over the country have been asking us for guidance on the safest and most secure passage through the transition from the accumulation phase of retirement planning through the distribution phase of retirement. In speaking with them, I discovered that neither Baby Boomers nor retirees are getting the direction they need to address what I call “The Key Three:”

- Tax Elimination

- Income Maximization

- Lifestyle and Legacy Preservation

Inflation is simply a tax that hits savers the hardest. Inflation is just another form of taxation! The government has been borrowing and spending money like a drunken sailor. Our national deficit is now a record $30 trillion (and counting). Consumers are having a tough time keeping up with the sky-rocketing cost of living so they are buying more things on credit. Consequently, consumer debt is now at an all-time high. All of this has many people wondering what to do.

Don’t fall victim to the reckless disregard of not having all aspects of your retirement planning in order. This Tuesday, at my Wealth Protection Webinar, I’ll be teaching proven solutions that our clients, Ron and Janice, from Colorado, were able to learn.

Click Here to learn how Ron and Janice are able to protect their retirement and to protect their children's inheritance, as well.

There would have been another $2 million in additional taxes on the Required Minimum Distributions (RMDs) that could be avoided using the right solution. These RMDs are causing income tax on 85% of their Social Security and increasing their Medicare Parts B and D premiums, costing them a projected $500,000 or more over their lifetimes. All of this is avoidable. They shared with me that their advisor has never addressed taxes in any capacity. Taxes were completely disregarded in their planning.

Ron and Janice shared that they were glad that they took the time to learn what they could do to protect themselves and their children’s legacy by attending my Wealth Protection Webinar. They learned what can happen when you disregard taxes in retirement!

Learn How You Can Stay Ahead of Inflation and Taxation!

This Tuesday, at my Wealth Protection Webinar, I will teach you how to get your money untaxed and how to protect it from being taxed when you pass it on to your children. The time to learn what you can do is in 2022!

You’ve worked hard for your money. Imagine, more financial success, less stress, less worry, less taxation and staying ahead of inflation. Learn how you can protect yourself from taxes, inflation and market losses.

To register for Tuesday’s no-cost, no-obligation, log on and learn financial educational event, simply follow these four simple steps:

- Go to www.RetirementProtected.com (or scroll down to the form below).

- Select the webinar date/time you prefer.

- Enter your information thoroughly – make sure to double check your email address.

- Click “Reserve My Spot!” to submit, that’s it!

Once you’ve registered, you’ll receive an email containing a personal access link to join Tuesday’s event. Don’t forget to add it to your calendar!

This misguided administration’s plans are targeting high income earners and strong savers in 401ks and IRAs. These are the people who will benefit the most from our proven solutions. Solutions with a track record of measurable results.

Register for your preferred webinar time now because these events have proven to fill up fast.

Those who attend this event will receive a complimentary copy of my latest eBook:

The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.

Spouses and Significant Others are Encouraged to Attend This Event Together

Chuck Oliver

Wealth Strategist | Best-Selling Author

We help Baby Boomers and Retirees thrive in retirement through a clear retirement road map that provides market correction and tax protection to optimize income and assets!

www.TheHiddenWealthSolution.com