Retirement Doesn’t Have To Be Confusing…

With all of life’s joys come financial challenges that can be overwhelming at times.

- ZHow can I lower my risk and increase my returns?

- ZHow can I organize and simplify my financial life?

- ZHow can I maximize the top tax savings strategies?

- ZHow do I maximize Social Security benefits?

- ZWhat are the most cost effective ways to obtain long-term care?

- ZHow soon can I secure and reach retirement?

- ZHow can I prevent my retirement from being reduced?

- ZWhen and how should I take my pension?

- ZWhen and how should I help my aging parents?

- ZHow can having my own business save taxes in retirement?

Work towards gaining clarity, direction & confidence.

Comprehensive Retirement Planning Management with Asset & Income Optimization

Learn how you can potentially mitigate retirement uncertainty

by de-risking your retirement with market correction* and tax protection.

Take action NOW to prepare & protect YOUR retirement!

“Imagine” more financial success, health, happiness & time with family!

Who we are

About Us

Chuck Oliver and his Wealth Architect Team educate Baby Boomers and retirees through a unique holistic and comprehensive planning process called – The Hidden Wealth Solution – which educates Baby Boomers and retirees on how to optimize their assets and maximize their income for retirement.

The Hidden Wealth Solution has been in business for 25 years helping Baby Boomers and retirees in three key focus areas: asset optimization, income maximization and tax elimination.

Our team also consists of licensed insurance experts with advanced tax-free insurance planning as well as Certified Mortgage Planning designations, state lending licenses, and real estate licenses.

For over two decades, The Hidden Wealth Solution team has been dedicated to helping people work towards peace of mind as they prepare for retirement.

Work towards gaining the direction, confidence and capability to potentially

make more, keep more and to pass more!

Imagine, a Personal Wealth CFO who enables you to discover and uncover your hidden wealth with ongoing optimization.

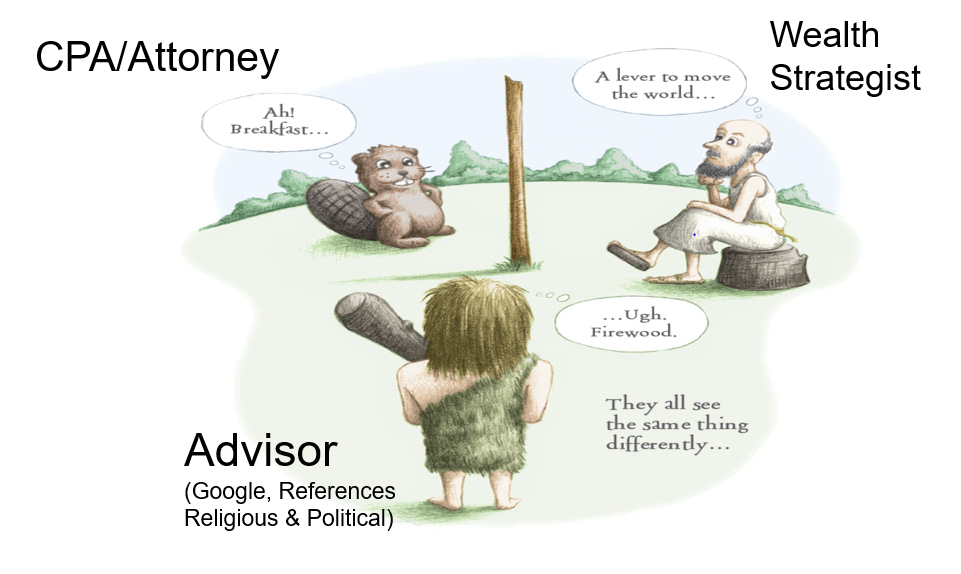

We help baby boomers and retirees see retirement differently!

What about my CPA, Attorney & Advisor?

You can’t get a 2nd opinion from the person that gave you the first one, they already gave you their first best opinion.

What we do

Our Solutions

You worked hard for your money; let us teach you how we work even harder to protect it.

RETIREMENT INCOME PROTECTION

Have a savings solution and aim to protect your retirement from taxes, market losses and inflation.

TAX “SAVINGS” PLANNING

Learn how you can potentially S.T.O.P unnecessary taxes on your retirement and prevent your IRAs from becoming IOUs to the IRS.

TAX-FREE LIFETIME INCOME

Learn how you can strategize towards freeing your retirement from taxes and potentially enjoy higher spendable retirement income.

STOCK MARKET PROTECTION PLANNING

Learn how to potentially reduce risk, increase returns, cut costs or even eliminate loss exposure with proven institutional and proprietary programs.

“LIVING” YOUR LEGACY

You’ve worked a lifetime to accumulate your wealth. Let us help you work towards leaving a legacy that’s important to you and protects those that matter most.

SOCIAL SECURITY MAXIMIZATION

Cost of living increases, claiming age, marital status and work history all complicate Social Security claiming strategies. Learn strategies designed to help maximize Social Security, prevent or reduce tax to your benefits and potentially avoid Medicare part B and D penalties.

request your s.t.o.p. analysis!

Learn how you can potentially (S.T.O.P.) unnecessary taxes on your retirement and keep your IRAs from becoming IOUs to the IRS!

Receive a best case scenario regarding the tax risk road your traveling. In under 30 seconds, see the tax liability exposure you are facing.

Saving

Tax

optimization

plan

A message from our founder

“I like to compare retirement planning to climbing Mount Everest. In climbing this mountain, more people are lost coming down from the summit than on the way up the mountain. The same can be said for retirement planning. There’s a lot of diligent planning that goes into accumulating money for retirement (going up the mountain) but, there’s very little planning done on distributing that accumulated money once someone is actually retired (coming down the mountain).

I want to teach you not just how to plan for retirement, I want to teach you how to plan at retirement. In other words, don’t just get to retirement, get through retirement. With the threat of astronomic tax rates, trade wars, volatile stock markets and rising interest rates, the time to learn is now!”

Hidden Wealth Radio

Each weekend, tune into Chuck’s broadcast on Hidden Wealth Radio.

Chuck discusses up to date information that provides direction and key strategic insights to help Baby Boomers and retirees thrive in retirement.

Find a station or browse through our archives and learn how to discover and uncover your Hidden Wealth in the areas of tax savings optimization as well as retirement income & asset maximization!

Webinars & Events

Our new educational webinar addresses protection from the coronavirus (COVID-19) market, the impact of the economic stimulus and the upcoming election. These already are or will be, making the economy unstable.

Those who attend this event will receive a digital copy of Chuck Oliver’s latest book, The Baby Boomer Retirement Breakthrough-The Unfair Advantage to a Safe and Secure Retirement.

Video Center

Our retirement video library contains a collection of quick and easy-to-understand tutorials that educate you on key strategies for wealth creation and preservation.

It’s never too late to learn how to optimize retirement income and assets!

educational retirement books

Books written by Chuck Oliver on building a retirement roadmap, maximizing your income and assets with tax-free benefits and planning ahead to ensure a financially secure retirement.

- Saving Tax Optimization Plan = S.T.O.P Over-Paying Taxes

- Personal Protected Pension Plan

- The Business Owner Protected Pension Plan

- Game Changers

- Power Principles for Success

- The Baby Boomer Retirement Breakthrough

- What to Do at 62

- My Debt Into Wealth

LEARN YOUR CURRENT RETIREMENT SAVINGS LEVEL OF RISK AND ACTUAL RETURN WITH RISKALYZE

Discover and define your Investor Risk Tolerance and take the guesswork out of your financial future while taking less risk and earning more return.

resources

Hidden Wealth Blog

Investing in your retirement through learning has proven a lifetime of positive results. We encourage Baby Boomers and Retirees to increase their knowledge in the areas of retirement and taxes.

Read through our blog and discover insights on how to protect and grow your retirement.

Have You Heard About the 10 Times Tax Deduction?

Please Click the Video to Watch This Important, Short Message In this week’s Hidden Wealth...

Remove Retirement Fear in an Election Year!

Please Click the Video to Watch This Important, Short Message In this week’s Hidden Wealth...

The Great Wealth Transfer Trap!

Please Click the Video to Watch This Important, Short Message Former U.S. Appeals Court Judge,...

Inflation Retirement Annihilation

Please Click the Video to Watch This Important, Short Message In this week's Hidden Wealth...

April 1st is RMD Fools Day!

Please Click the Video to Watch This Important, Short Message In this week's Hidden Wealth...

Biden’s Budget Bringing Trillions in New Taxes!

Please Click the Video to Watch This Important, Short Message In this week's Hidden Wealth...

Secure your seat & potentially your retirement today!

Save a seat in Chuck Oliver’s educational wealth protection webinar where you can learn how to potentially optimize your assets and work towards creating a tax-advantaged lifetime retirement income along with a tax-free legacy.