Claim your free ebook now!

Thank you for submitting your information for your S.T.O.P. Analysis.

Please click here or click on the cover image to download our newest updated edition on how to protect your retirement from taxes.

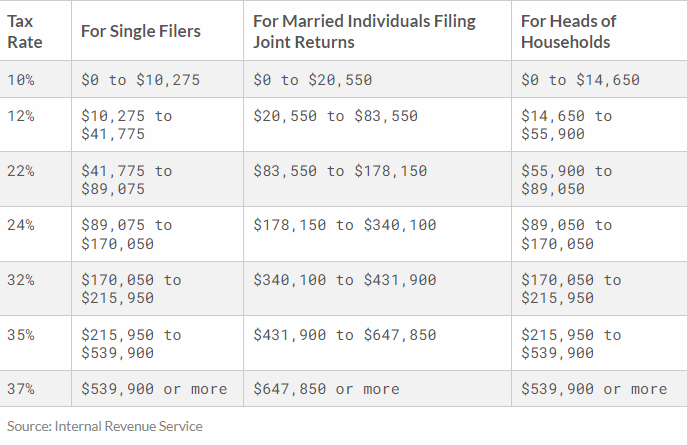

2022 Federal Income Tax Rates & Brackets

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be shown in the table below. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

Helpful tipclick the image to enlarge

2022 CAPITAL GAINS TAX RATES & BRACKETS

Long-term capital gains are taxed using different brackets and rates than ordinary income.

Helpful tipclick the image to enlarge

Hidden Wealth Radio

To hear more from Chuck Oliver, tune into Hidden Wealth Radio each weekend. Chuck discusses up to date information that provides direction and key strategic insights to help Baby Boomers and retirees thrive in retirement.